best Penny stocks for 2021 in india - multibagger stocks.

best Penny stocks for 2021 in india - multibagger stocks.

We will cover the following topics.

- penny stocks

- Penny stocks list

- penny stocks India

- best Penny stocks for 2021 in india

- Penny stocks to buy today india

- best Penny stocks to buy now

- debt free penny stocks

- best penny stocks to buy now india

the first best Penny stocks for 2021 in india that i would like to add in the category of Penny stocks list. the name of the stock is-

1. rana sugars limited

Image source - groww

so rana sugar's limited rana group company was founded in 1992 together with punjab agree corporation. In year 2002 rana sugars limited has found out an indication co-generation project to supply extra power from the most important by-product of sugar and export it to punjab state electricity board rather group of companies made a humble beginning in mid mid-80s. when rana guji singh group's founders found out agro boats limited, a craft paper unit in punjab. success of this maiden venture was duly recognized by epic state owned industrial promotion corporations and this led to runner group's ventures with different state-owned corporations. after the success of agrobots rana group diversified into sugar manufacturing by setting its first unit at buddha savion in punjab in 1993 over the years. The group has established itself as a pioneer within the sugar industry and today the group is in sugar alcohol power generation and textile sector. sugar is extremely vital a part of the agricultural economy and rana group supports the explanation for the sugar farmers the group is actively involved the farming community so as to enhance yields and quality of the sugarcane. quality consistency and relationships have propelled the group to become one among the foremost successful industrial houses in north india and rana sugar's limited.

rsl is additionally a market leader in punjab medium liquid sector the corporate has portfolio of well established liquid brands and rsl is additionally a preferred bottler of several leading liquid brands. now the alcohol is produced from both molasses and grain and molasses may be a byproduct of sugar that features a specific amount of sugar content. this is often extracted through a technological process and identifying the worst opportunities within the ethanol sector.

rsl radar sugars has proposed to line up an ethanol plant which will use molasses as staple from rsl's existing facilities. now this company has reduced its debt and it is debt free penny stocks. the stock is trading at one point zero five times its locally very attractive company has delivered good profit growth of thirty eight point four nine percent ceger over the last five years. it's given positive end in the march quarter and with the return on capital input of 21.3. it's anattractive valuation with the one you recognize enterprise value to capital employed. now if you check out the profit and loss analysis the sales is near thousand two twenty two crore and therefore the net income is near 158 crore. so radar sugar currently trading near 25 i feel . good price to enter would be here that's 23 rupees and that i think this stock has the potential to get some good returns within the coming few months. overall sugar sector is bullish and therefore the stock which is trading at very low price has the potential to get some good returns. from here a bit like you recognize renuka sugar i suggested you at 14 and it's currently trading at 36. so like quite one hundred pc return in one month. so this truck is additionally seems like that and keep a stop loss at around 20 and you recognize we will enter within the stock at the present price i feel . the stock are you able to know go higher from here so this is often the primary stock that i would like to share with you. the primary over the counter stock which i think has the potential to offer some good returns now let's check out the second penny stocks India therefore the second best penny stocks to buy now the name of the corporate is-

rsl radar sugars has proposed to line up an ethanol plant which will use molasses as staple from rsl's existing facilities. now this company has reduced its debt and it is debt free penny stocks. the stock is trading at one point zero five times its locally very attractive company has delivered good profit growth of thirty eight point four nine percent ceger over the last five years. it's given positive end in the march quarter and with the return on capital input of 21.3. it's anattractive valuation with the one you recognize enterprise value to capital employed. now if you check out the profit and loss analysis the sales is near thousand two twenty two crore and therefore the net income is near 158 crore. so radar sugar currently trading near 25 i feel . good price to enter would be here that's 23 rupees and that i think this stock has the potential to get some good returns within the coming few months. overall sugar sector is bullish and therefore the stock which is trading at very low price has the potential to get some good returns. from here a bit like you recognize renuka sugar i suggested you at 14 and it's currently trading at 36. so like quite one hundred pc return in one month. so this truck is additionally seems like that and keep a stop loss at around 20 and you recognize we will enter within the stock at the present price i feel . the stock are you able to know go higher from here so this is often the primary stock that i would like to share with you. the primary over the counter stock which i think has the potential to offer some good returns now let's check out the second penny stocks India therefore the second best penny stocks to buy now the name of the corporate is-

2. lumax auto technology

now talking about this company lumax auto is a component of lumax dk gene group. the corporate may be a auto component manufacturer with a well diversified product portfolio and it is best Penny stocks to buy now.

lumax auto technologies limited was incorporated within the year 1981. now lumax also supplies to most of the leading two wheeler within the country and is present within the two wheeler three village segments.

50 percent of fi 22 sales passenger cross segment around 20 percent. now the oem segment accounts for 80 percentage of fi 20 revenue. while the after market segment accounts for 18 percent of the revenue. it's the market leader geared shifters with around 70 percentage of market share. this company's key customers are bajaj auto lumax industry smart silica india etc and a few of the products include intake stems integrate plastic modules to villages and lighting gear shifters seat structure mechanisms led lighting and aerospace and defence engineering services. the rumex auto is predicted to be a beneficiary of improving business outlook for automotive business the corporate features a well diversified customer and merchandise portfolio de-risking. its business model from dependency on one customer or one product. now the corporate features a strong presence within the two wheeler and pv segments which contribute 48 percent and 20 percent to total revenue respectively. we will expect lumax auto to be a beneficiary of demand into wheeler and pv segments on account of strong relationship with the corporate also enjoys preference when it expands its product portfolio.

we can expect lumax auto to profit from favorable changing product trends. like you recognize shifting from halogen lights to led lights in tubular four wheeler increase use of lighter plastic materials and increasing automatic drive in four wheeler shifting from manual gears to automatic gears. this all you recognize will positively impact this company so moreover we will expect lumax sorter to profit from the increased revenue per client. the corporate has received new businesses for eminence star gear shifter and control housing maruti's upcoming suv plastic cars and tata motors on build suv air cleaner assembly and therefore the two wheelet segment. new business was received from bajaj ev helmet box lamp ct 100 and pulsar seed call and site cover.

so this company also has reduced debt and currently it's virtually debt free penny stocks. so we will say it is a debt free company and with growth in income of 6.24 percentage the corporate declared very positive end in the march quarter, also another positive sign is that this company has high institutional holding at around 25 percentage. so this token looks good for the longer term and if you check out the chart of this company this stock has market cap of only around 1 000 crores so this is often some you recognize over the counter stock on the idea of market capital now this truck is currently trading near 138-149 and that i think. if there's any correction and if you're ready to buy the stock near the support which is here that's around 140 i feel . you recognize you'll enter during this company and that i think subsequent few years this stock has the potential to travel higher and achieve some excellent targets within the future, so this stocks is also considered to Penny stocks to buy today india. so you ought to do your analysis company this stock are often a multibagger stocks in india 2021. it is a over the counter stock supported market capital which has the potential to get some good returns now let's check out another stock that i feel are often an honest bet and therefore the name of the 3rd which is best Penny stocks for 2021 in india is-

lumax auto technologies limited was incorporated within the year 1981. now lumax also supplies to most of the leading two wheeler within the country and is present within the two wheeler three village segments.

50 percent of fi 22 sales passenger cross segment around 20 percent. now the oem segment accounts for 80 percentage of fi 20 revenue. while the after market segment accounts for 18 percent of the revenue. it's the market leader geared shifters with around 70 percentage of market share. this company's key customers are bajaj auto lumax industry smart silica india etc and a few of the products include intake stems integrate plastic modules to villages and lighting gear shifters seat structure mechanisms led lighting and aerospace and defence engineering services. the rumex auto is predicted to be a beneficiary of improving business outlook for automotive business the corporate features a well diversified customer and merchandise portfolio de-risking. its business model from dependency on one customer or one product. now the corporate features a strong presence within the two wheeler and pv segments which contribute 48 percent and 20 percent to total revenue respectively. we will expect lumax auto to be a beneficiary of demand into wheeler and pv segments on account of strong relationship with the corporate also enjoys preference when it expands its product portfolio.

we can expect lumax auto to profit from favorable changing product trends. like you recognize shifting from halogen lights to led lights in tubular four wheeler increase use of lighter plastic materials and increasing automatic drive in four wheeler shifting from manual gears to automatic gears. this all you recognize will positively impact this company so moreover we will expect lumax sorter to profit from the increased revenue per client. the corporate has received new businesses for eminence star gear shifter and control housing maruti's upcoming suv plastic cars and tata motors on build suv air cleaner assembly and therefore the two wheelet segment. new business was received from bajaj ev helmet box lamp ct 100 and pulsar seed call and site cover.

so this company also has reduced debt and currently it's virtually debt free penny stocks. so we will say it is a debt free company and with growth in income of 6.24 percentage the corporate declared very positive end in the march quarter, also another positive sign is that this company has high institutional holding at around 25 percentage. so this token looks good for the longer term and if you check out the chart of this company this stock has market cap of only around 1 000 crores so this is often some you recognize over the counter stock on the idea of market capital now this truck is currently trading near 138-149 and that i think. if there's any correction and if you're ready to buy the stock near the support which is here that's around 140 i feel . you recognize you'll enter during this company and that i think subsequent few years this stock has the potential to travel higher and achieve some excellent targets within the future, so this stocks is also considered to Penny stocks to buy today india. so you ought to do your analysis company this stock are often a multibagger stocks in india 2021. it is a over the counter stock supported market capital which has the potential to get some good returns now let's check out another stock that i feel are often an honest bet and therefore the name of the 3rd which is best Penny stocks for 2021 in india is-

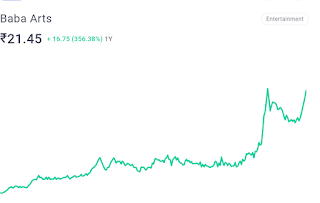

3. baba arts limited

the company also plans to venture into the business of acquisition of varied rights for the south indian movie industry which are home video rights overseas rights and audio rights and baba arch is engaged within the business of movie video tape and tv program production services. you would possibly have heard about south and india this company is that the one which produces it now if you check out the chart of this stock it made a high of around 22 rupees then you recognize we will see some correction i feel it should be multibagger stocks to buy now. if you're ready to buy this stock at this support that's 14.9 rupees i feel . you'll enter during this company so await some collection and near 50 moving average that's around 14.9 rupees is that the price. you recognize where you'll you recognize i think you'll enter during this stock alittle quantity like one thousand two thousand or around five thousand rupees you'll

invest within the company. if the stock you recognize runs then it'd you recognize give some excellent returns.

So friends in today's article i shared with you three

companies or three looks good Penny stocks list with you. please do your own analysis and if you wish it in fact you'll invest in them and check out to form some profit out of them.

invest within the company. if the stock you recognize runs then it'd you recognize give some excellent returns.

So friends in today's article i shared with you three

companies or three looks good Penny stocks list with you. please do your own analysis and if you wish it in fact you'll invest in them and check out to form some profit out of them.

Post a Comment